Connect for Platforms: Managing customers

Mollie Connect assists you in monitoring and managing your customer’s onboarding process through a set of dashboards, providing both an overview of all your customers, as well as a detailed per-client view.

NoteYour app needs to request

organizations.readandonboarding.readpermissions to access your customers' data in the dashboards.

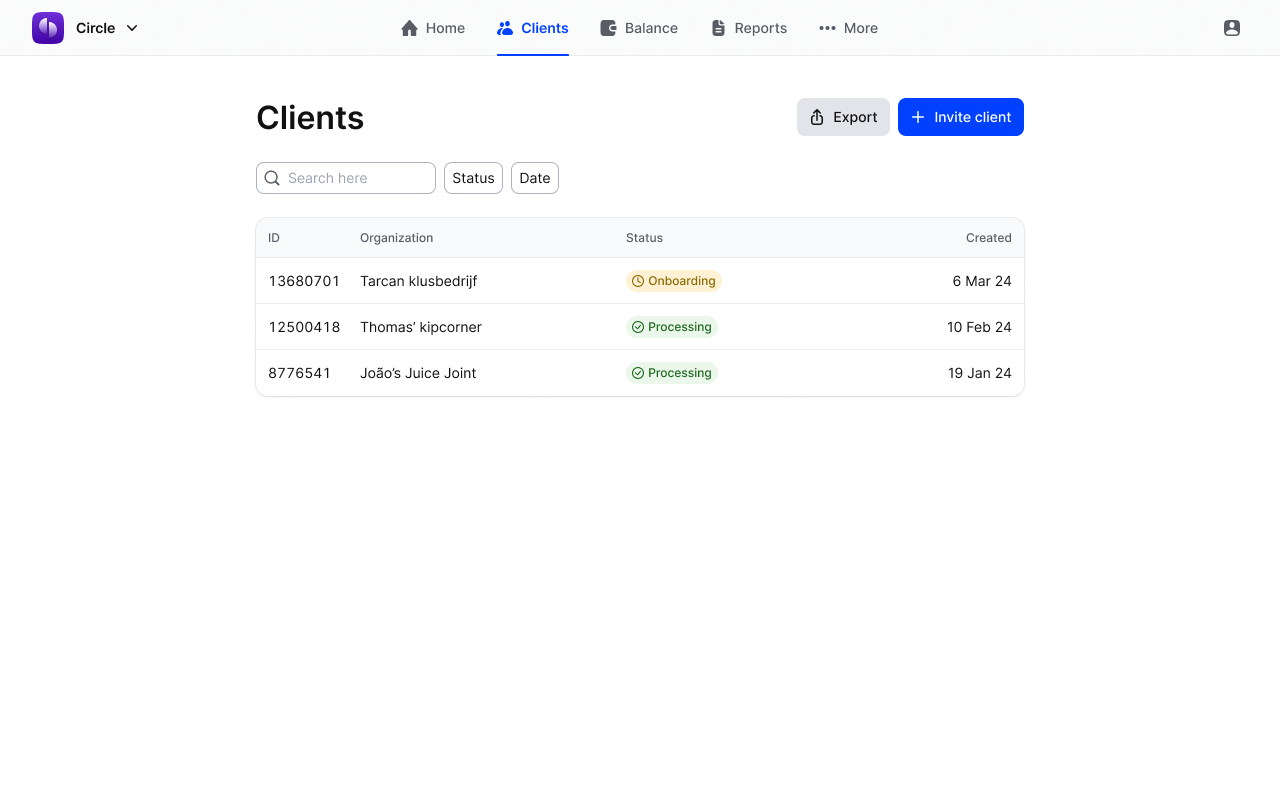

Partner Clients tab

This page offers an overview of all connected and onboarding customers, searchable by Organization name and ID. You can check the onboarding status (needs-data, in-review, completed) and the blocked payments indicator (available, pending, blocked) to identify accounts that need assistance.

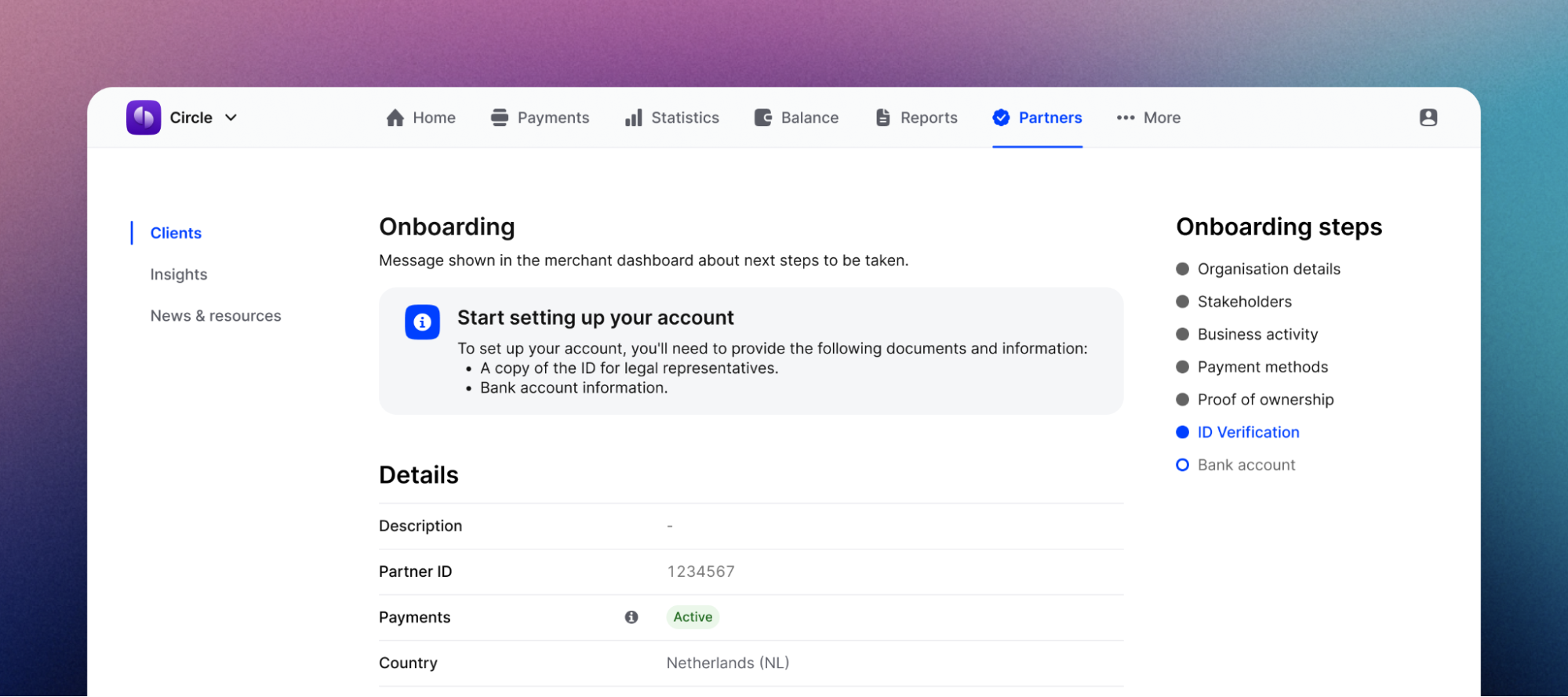

Detailed Clients page

Clients page is only visible when the OAuth app has

organizations.readpermission granted.

Each connected customer has a Client detail page where you can check organization details, a list of payment profiles (including statuses and enabled payment methods), and an overview of their onboarding steps. This provides full visibility for guiding your clients through the onboarding in the most effective way:

Customer onboarding

Once your client has submitted all necessary data and enabled the required settings, Mollie initiates the review process. Ensure your clients are prepared for onboarding using the checklist below:

- Organization details provided.

- Stakeholder information entered.

- Website & products/services details provided.

- Payment methods activated on the profile level.

- IDs of legal representatives uploaded.

- Bank account details added.

Find more information on customer onboarding in the following articles:

Profile management

Since all payments your customers create through your platform need to be associated with specific customer profiles, you should ask your customer which profile should be used to process payments through your platform.

For customers with an existing Mollie account, you can use the (List profiles endpoint to retrieve all of their existing profiles and prompt them to select which of these profiles should be used by your platform.

Alternatively, you can prompt customers to create a new profile when they connect with your platform, or automatically create a new profile via the Create profile endpoint.

Payment methods are managed at the profile level, and you can let customers add or remove payment methods from their preferred profile within your platform via the profiles endpoint.

Payment creation

Using OAuth for authorization, you get the access tokens that give you control over your customer's account (within the scopes you requested), commonly allowing payment creation on their behalf.

Since payment creation requires association to a specific profile, you’ll always need to specify the profileId parameter within the payment.

While it is possible to change your own payout frequency and payout day, it is however not possible for a partner account to change the payout day or payout frequency of their connected clients.

Monitoring profile & account status

Profiles statuses might change, due to the reviewing process Mollie conducts due to regulatory requirements. We therefore recommend to periodically fetch the Profiles status so that your customers are aware of their profile's availability.

Managing profile for the customer

Depending on the level of control over the profiles connected to your platform, you can additionally take the following actions on behalf of the customers:

- Create profiles - create a profile to process payments on.

- List profiles - retrieve a list of all of your connected profiles.

- Update profiles - update an existing profile with the new data.

Please be aware that change to certain data updates will triggeradditional verification, which status you can then monitor through Profiles API. - Delete profiles etc.

- Enable payment methods - enable payment method(s) for a specific profile. Most payment methods can be activated immediately. However, we need to perform further checks to activate certain payment methods like Klarna, SEPA Direct Debit and credit cards.

- Disable payment methods - disable payment method(s) for a specific profile.

Managing reporting

Mollie offers a variety of Business Operation APIs if your platform needs to pull your customer's payment data from Mollie to offer different reporting services (e.g. for reconciliation):

- Settlements API - reports all transactions of a customer, based on a settlement which represents a payout from Mollie balance to customer’s bank account.

- Balances API - reports all transactions in a bank feed format, allowing to retrieve also open and unsettled balances, which provides more optimal reconciliation.

- Invoices API - reports payment and other Mollie fees which the customer is charged with.

Since reporting data is aggregated on the account level, you don't need to include the

profileIdfor these calls.

Disconnecting customers

If you decide to disconnect a customer or your customer decides to disconnect from your OAuth app, the next steps are as follows:

- Customer disconnects

You will first receive an authorization error, which will prompt you to refresh the token. The refresh token request will fail with theinvalid_granterror, which means the customer has disconnected from your application. - You disconnect a customer

Revoke the token you no longer need in order to disconnect the customer from your app.

Updated 9 months ago