BANCOMAT Pay

BANCOMAT Pay is an innovative payment service that empowers consumers to make hassle-free e-commerce purchases directly from their mobile phones. With BANCOMAT Pay, all PagoBANCOMAT cardholders gain access via their bank's app or via the dedicated BANCOMAT Pay app. It's as simple as linking your bank account to your phone number and IBAN.

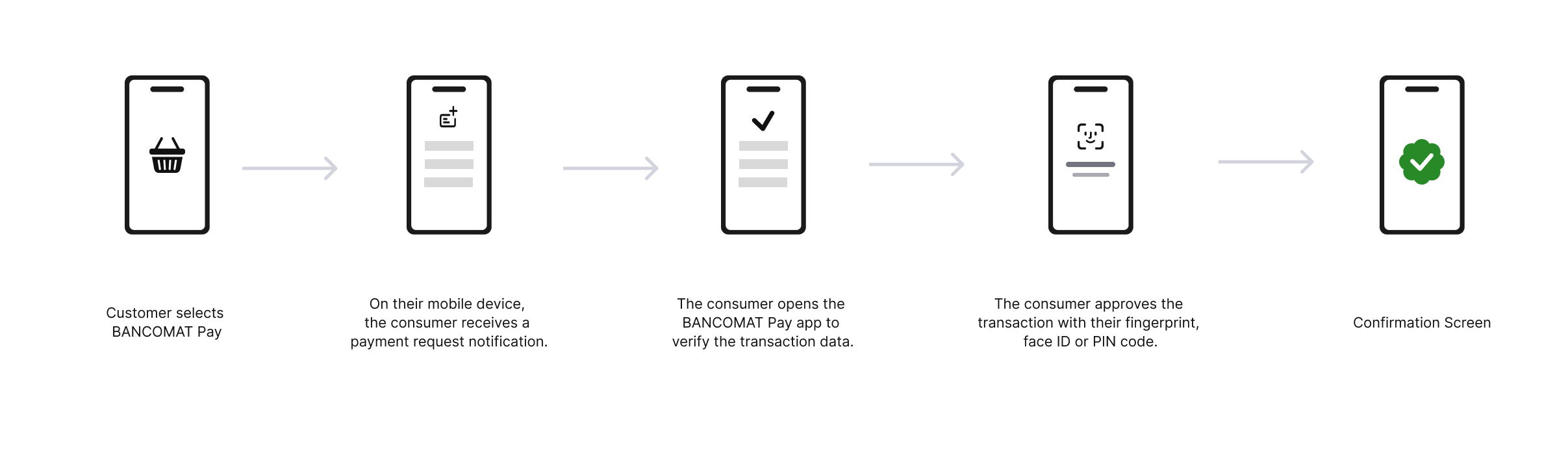

How it works

Key information

Available country codes |

|

Supported merchant locations |

|

Supported currencies |

|

API method name |

|

Supported API | |

Minimum transaction amount | EUR 0.01 |

Maximum transaction amount | EUR 1,000,000.00 |

Session timeout | 1 hour |

Supported operations | Auto-Capture |

Refund validity | 12 months |

Recurring | No |

Settlement delay | 4 business days |

Chargeback risk | Yes |

Chargeback period | 90 days |

Charge | Instant charge |

Resource pack |

Disputes

Disputes can arise with BancomatPay transactions, BancomatPay consumers must submit a complaint within 60 calendar days of purchase and provide the required documentation based on the dispute type.

Dispute flow

- Dispute Notification | The consumer files a dispute through the issuer bank within 90 calendar days of their purchase

- Request for Information| The Mollie chargeback team will contact you (the Merchant) directly providing you with details to the disputed transaction. You (the merchant) will be asked to provide challenging information on the dispute.

- Information Supplied | You (the merchant) will provide challenge information on the dispute to the Mollie Chargeback team via email.

- Decision | The issuing bank decides the dispute resolution. If the issuing bank decides the dispute in favour of you (the merchant), the transaction amount will remain available in your balance. If the issuing bank decides in favour of the consumer, the chargeback and dispute fee are posted.

Final Resolution: Merchant’s Response:

- If Documents are Provided | You (the merchant) provide the necessary documents to prove the correct action. The Acquirer then closes the dispute in favour of you (the merchant).

- If Documents are Not Provided | The dispute is settled in favour of the consumer, and you (the merchant) are obliged to reimburse the relevant amounts.

- Conflict Resolution | If there is a conflict between the Issuer and the Acquirer about the dispute's resolution, BANCOMAT SpA can be asked to give a final, non-contestable decision. All parties must comply with this decision.

Updated 10 months ago