Pay by Bank

Pay by Bank is a payment method that allows customers to pay for goods or services directly from their bank account. Unlike traditional card payments, this method uses the bank's secure infrastructure, leveraging Open Banking APIs, to facilitate instant or near-instant transactions.

How it works

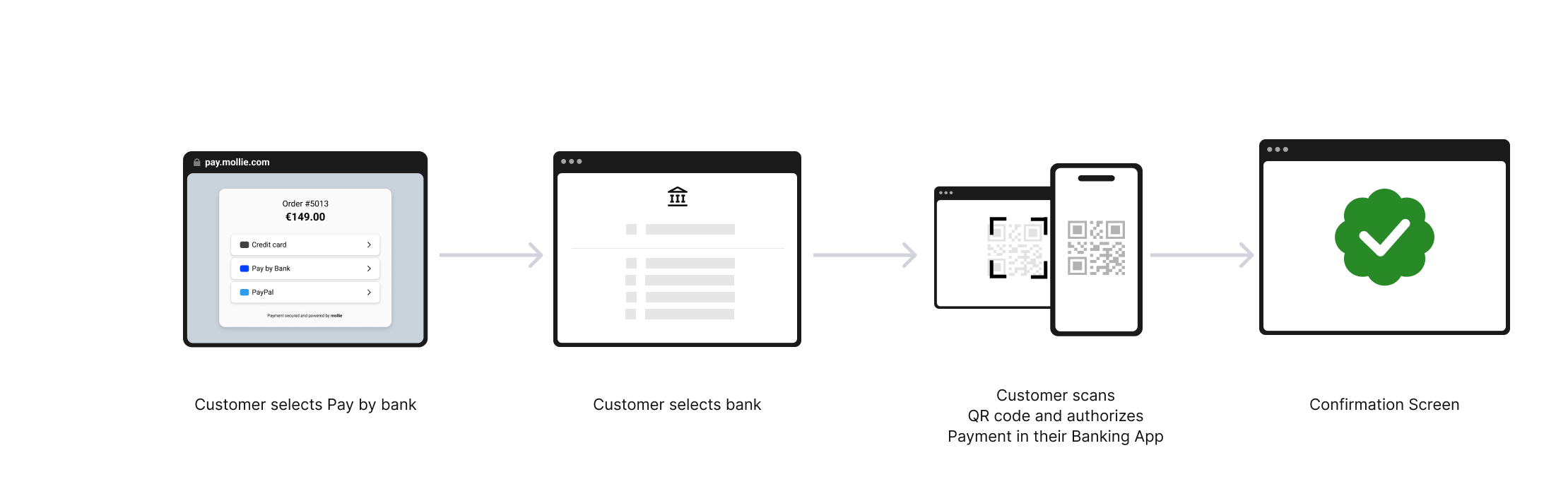

The process of paying by bank is straightforward and user-friendly:

- Payment Initiation: the customer selects "Pay by Bank" at the checkout

- Bank Selection: the customer chooses their bank from a provided list.

- Customer Authentication: the customer is redirected to their bank’s secure portal or app. Here, they log in and may need to provide additional verification, such as a code sent to their mobile device or biometric data like a fingerprint.

- Payment Confirmation: the customer reviews the payment details, including the amount and recipient, before confirming the payment.

- Funds Transfer: the bank processes the payment and transfers the funds from the customer’s account to Mollie which will then reflect the funds in the merchant's balance.

- Notification and Settlement: up on successful payment initiation, the consumer is redirected to the confirmation page of the merchant (redirectUrl). The payment will stay in status "pending" until the funds have arrived on Mollies account and will then immediately transition to "paid". Once the payment is "paid", merchants will receive the payouts in their next payout cycle.

How long does it take for a Pay by Bank payment to transition to status "paid"?The transition period on how long it takes for a successful payment initiation to transition from status "pending" to "paid" is highly dependent on the consumer bank (issuing bank) and wether they do send the transaction as Standard SEPA Credit Transfer (SCT) or Instant SCT. For Instant SCTs the transition should not take longer than a few minutes, for Standard SCTs it can take up to 2-3 business days.

Based on

Regulation (EU) 2024/886 on Instant Payments, starting Oct 9th, 2025 all European Banks need to support sending Instant SCT. However, some banks might be experiencing a delay in the implementation of this regulation.This is why we provide our merchants the option to only offer Pay by Bank for Instant SCT enabled banks to their consumers, better supporting use-cases that depend on instant payment notifications. If interested please contact your Mollie contact or reach out to our support team.

B2C vs. B2B supportPlease note that the OpenBanking standard only requires Banks to support standard bank accounts, but not business bank accounts. This means banks do not have to support business bank accounts for the Pay by Bank flow, yet some might have decided to support it anyhow.

Key information

Available country codes |

|

Supported merchant locations |

|

Supported currencies |

|

API method name |

|

Supported API | |

Minimum transaction amount | EUR 0.01 GBP 0.01 |

Maximum transaction amount | EUR 50,000.00 |

Session timeout | N/A |

Supported operations | Full Auto-Capture |

Refund validity | 365 days |

Recurring | No |

First Payment Method | Yes. Can be used as first payment Method for Recurring Payments . |

Settlement delay | 2 business days |

Chargeback risk | No |

Chargeback period | N/A |

Resource pack |

Updated 20 days ago