SEPA Direct Debit

The standard method for collecting Euro-denominated recurring payments, from regular subscription payments and monthly donations, to one-click payments or paying in instalments.

Currently, 36 countries use the SEPA Direct Debit system which makes SEPA Direct Debit incredibly powerful for Europe-wide expansion of subscription services.

How it works

Key information

Available country codes | EU countries: |

Supported merchant locations |

|

Supported currencies |

|

API method name |

|

Supported API | |

Minimum transaction amount | 0.01 EUR |

Maximum transaction amount | 1,000.00 EUR (Default Limit) |

Session timeout | 60 minutes / 15 minutes |

Supported operations | Auto-Capture |

Refund validity | 365 days |

Recurring | Yes |

Settlement delay | 9 business days |

Chargeback risk | Yes |

Chargeback period | Within 8 weeks. |

Resource pack |

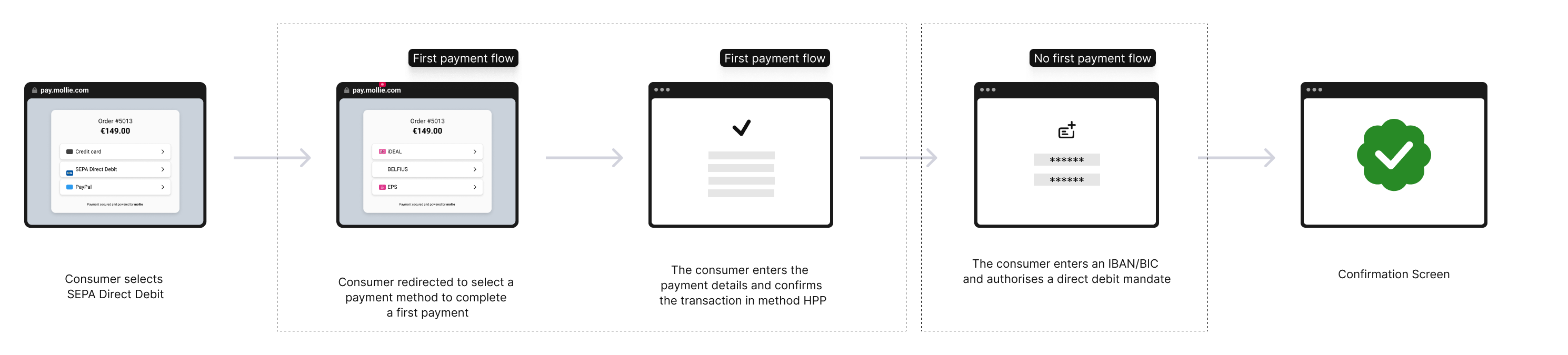

First Payment Authorisation

In order to get started with recurring payments you require the customer’s consent. This can be done via a first payment. It’s similar to a regular payment, but the customer is shown information about your organization, and the customer needs to complete the payment with the account that will be used for recurring charges in the future. After the first payment is completed successfully, the customer’s account will immediately be chargeable on-demand, or periodically through subscriptions.

The following methods support first payments for SEPA Direct Debit

- Bancontact

- Belfius

- EPS

- iDEAL

- KBC Payment Button

- MyBank

- Trustly

- Pay by Bank

Updated 10 months ago