QR codes

In the context of payments, QR codes enable customers to transfer the payment flow from their desktop or laptop computer to their mobile device. This is the so-called desktop-to-mobile flow.

QR codes also allow your customers to pay without requiring manual input leading to lower error rates.

In most cases, this works by scanning a QR code during the payment process using a dedicated app on a phone. For example, iDEAL payments support a QR code that can be scanned using the iDEAL app or directly from within the banking app. The customer then completes the transaction from his or her mobile device.

At Mollie, we support two types of payment QR codes: The payment-specific QR codes and the payment link QR codes.

- A payment method-specific QR code is created by Mollie and follows the same expiry pattern as the basic payment flow. When a payment with a QR code expires, the QR code itself expires as well. This type of QR code can be created via the Payments API or via the Mollie mobile app. This type of QR code should only be used for checkout and in-store scenarios and can only be scanned via specific applications. See more information below on the supported methods and how a consumer should use the QR code.

- A payment link QR code. This QR code stays valid for a longer period and can be used for any method available at Mollie. These methods should be activated in your Mollie account under ‘profiles’.

We advise to only use mobile-friendly methods, such as PayPal, Bancontact, and iDEAL. This type of QR code can be generated by creating a payment link via the Payment Links API and converting the paymentLink URL to a QR code via most common QR code tools available for most programming languages. The expiry time of the QR code can be defined via the expiresAt parameter. This type of QR code must be scanned with the camera app of the phone, or in Belgium, via any banking app.

Payment method-specific QR codes

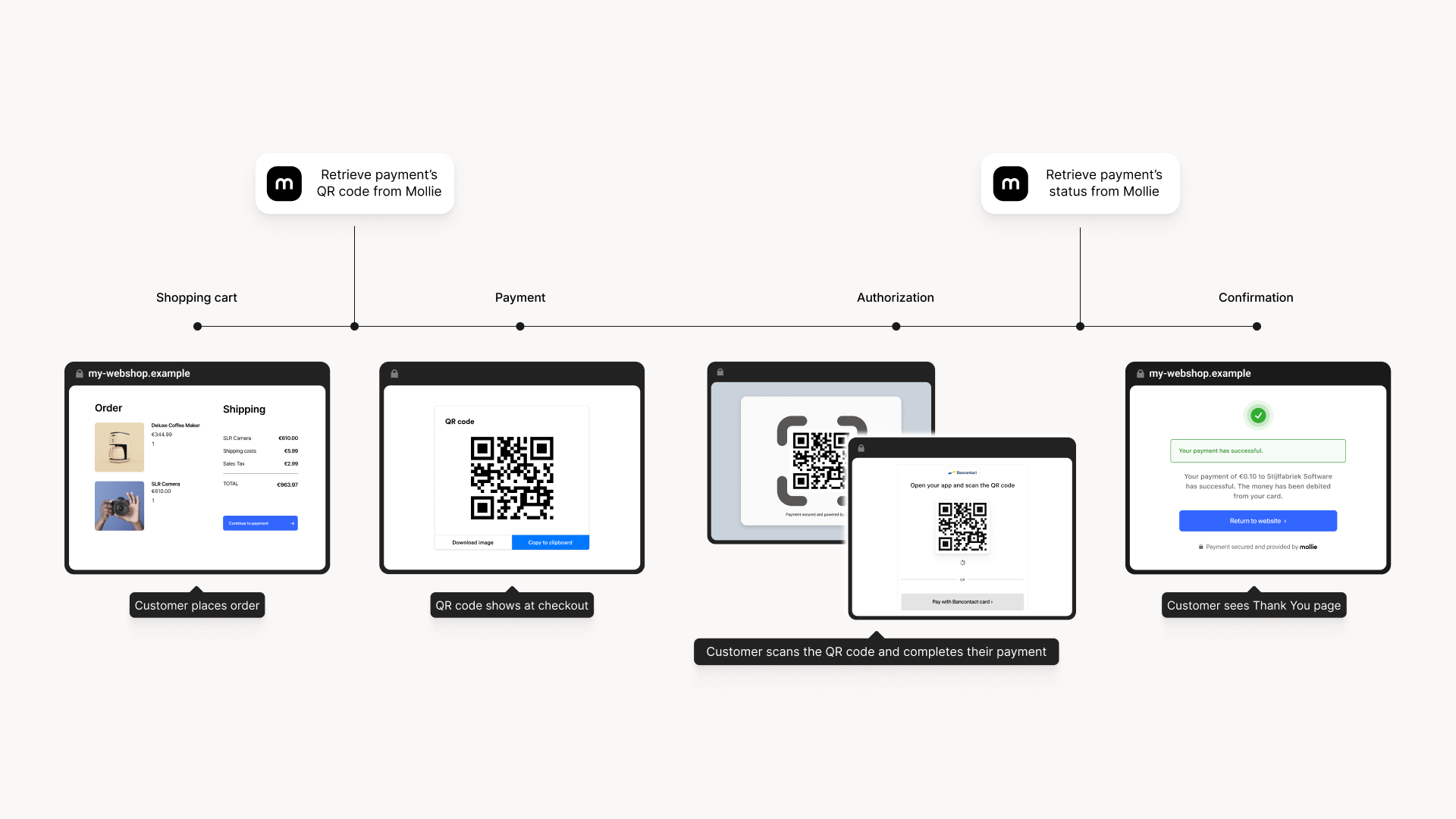

How do payment method-specific QR codes work?

- You generate a QR code for a payment method using the Mollie Payments API.

- You show the QR code to the customer during the checkout

- The customer opens the app on a mobile device and scans the QR code.

- The customer finishes the payment in the app on the mobile device.

- Mollie informs you of the payment status change using the webhook.

- The customer is redirected back to the webshop on their computer.

Only iDeal QR works in the test mode.

Supported payment methods

| iDEAL | iDEAL QR codes can be scanned using the app of you bank, the dedicated iDEAL app, or the iPhone camera app directly. After scanning the code, the customer can easily pay via their banking app. |

| Bancontact | Bancontact QR codes can be scanned using the Bancontact app, Belgian mobile banking apps, or the iPhone camera app directly. The QR code is only available for payments under €1500.00. |

| Bank transfer | Many mobile banking apps support scanning EPC QR codes for SEPA credit transfers. Note that there is no real-time feedback for this payment method. |

Implementation options

Two options for implementation are available:

| Mollie Checkout | Mollie Checkout contains QR codes at all the right places and handles the QR code logic for your application. It supports real-time feedback to the customer after they finish the payment. |

| Custom implementation | Should you want to, you can implement QR codes in your own application using the Mollie API. Some special considerations need to be taken into account, they are listed below. |

Retrieving QR codes

The QR code can be retrieved by adding the details.qrCode include to the payment creation API call, and a method parameter (exactly one of ideal, bancontact or banktransfer) to the body of your request as detailed in the Create payment endpoint.

POST https://api.mollie.com/v2/payments?include=details.qrCode

The API will return a qrCode object in the details object. The QR code can contain either a data:image/ URI (i.e. an image encoded in an URI) or an https:// URL pointing to the QR code image, depending on the payment method. You should support both.

QR codes are only included in the API as long as the payment has the open status. For iDEAL, the QR code is only available if no issuer has been selected yet.

Custom implementation

The QR code flow is largely similar to normal payment flow.

Redirecting the customer

After the payment, we will call the webhook to inform your application of the payment status changes. Since the customer has completed the payment on the mobile device, it is your task to ensure that a payment success page is automatically shown to the customer on the desktop or laptop computer.

Preferably, you should use a real time channel like websockets to ensure an optimal checkout experience.

Note that after the payment, the customer will also be redirected to the redirectUrl on the mobile device for some payment methods (such as iDEAL). For Bancontact, a special thank you page is shown on the mobile device.

For iDEAL you should make sure that the customer receives instructions to continue the shopping process on the device on which he or she initiated the payment, and an instruction to close the window on the mobile device.

More on the checkout flow in our Hosted checkout article.

Updated 3 months ago